Visa: Georgia is a flagship market for contactless payments

Georgia is one of the top six countries in the region where people have and use a Visa card, and the country eagerly accepts new technologies, says world leader in electronic payments Visa International.

High officials from Visa visiting Georgia’s capital Tbilisi this week said Georgia was the first country in the region to launch the Host Card Emulation in 2015.

Georgia also led the way by issuing Visa payWave and by introducing contactless micro tag stickers, where 28 percent of all face-to-face Visa transactions in Georgia were made on VisapayWave cards in September 2015 – not long after the technology arrived in the country.

The speakers briefed journalists on the latest global trends in the payments industry. Photo by VISA.

This readiness to accept new technologies encouraged Visa to further invest in Georgia, launch innovative products and deepen the established partnerships with leading Georgian banks, the Government and law enforcement agencies, said the Visa officials.

Visa’s business is focused on growing electronic payments and displacing cash in the system. With Georgia being one of the most progressive and innovative country’s in the region, and a flagship market for VisapayWave and contactless payments, we believe that we are very much on track to achieving this goal,” said Mandy Lamb, Visa Group Country Manager of CIS and South-East Europe.

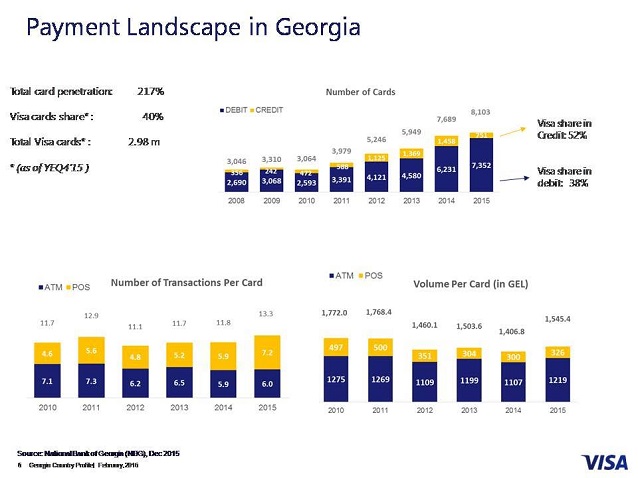

See the Visa payment landscape in Georgia:

In the near future Visa will launch new products in Georgia including the Visa Token Service and Visa Developer to provide a more secure financial environment in Georgia.

Visa is offering a payments ecosystem … [that provides] the tools and services that help develop new, deliver secure, fast and reliable payments services across diverse commerce experiences,” said Andrei Aleikin, Visa’s senior director of emerging products and innovations for CIS and SEE.

This is why we opened up our network through Visa Developer, an open platform for developers offering API interfaces for direct access to new Visa services. In doing so, we aim to accelerate the migration to new digital commerce experiences and support of consumers who increasingly rely on connected devices to shop, pay and get paid,” he said.

Meanwhile Hector Rodriguez, Visa’s regional risk officer for Central and Eastern Europe, Middle East and Africa, said Georgian customers should feel confident while using their Visa cards as multiple security features were in place.

With the speed of payment innovations in the world and in Georgia particularly, our role as one of the world’s leading payments network is to make sure every time a Visa cardholder enters their card details online or dips, swipes, or taps their Visa card at the point-of-sale, they know they are accessing the most secure way to pay. Visa employs multiple layers of security that work together to help us manage fraud,” he said.

Rodriguez added Visa was working with Georgian issuers to strengthen consumer protection in the market by introducing rules that will provide Visa cardholders "peace of mind” whenever and wherever they use their Visa cards.

Tweet

Tweet  Share

Share