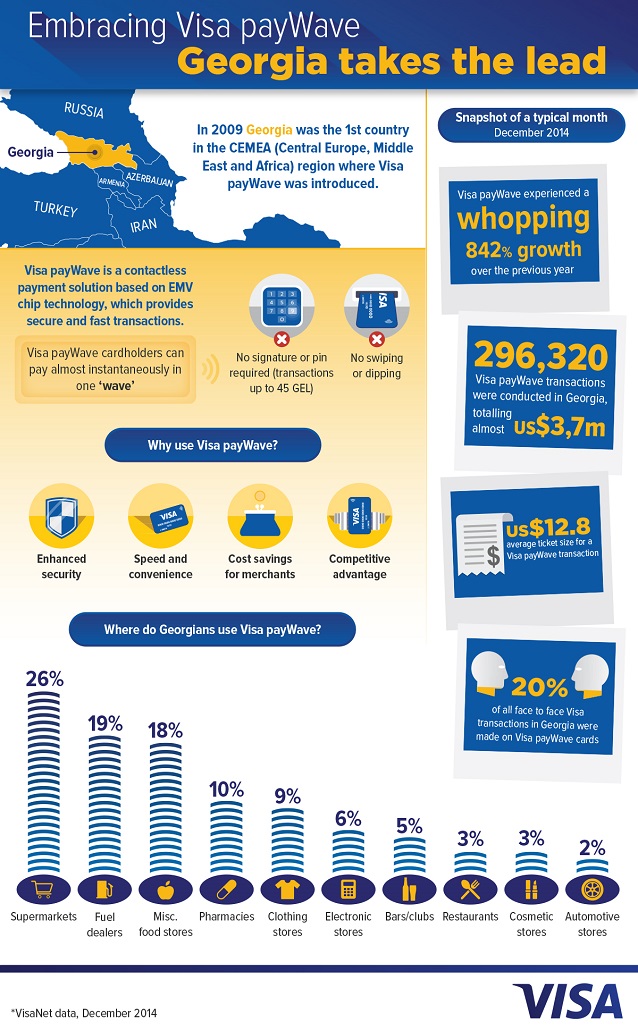

Georgia embraces Visa payWave technology (Infographics)

Georgia is the leading nation among more than a dozen countries in the Commonwealth of Independent States (CIS) and South-East Europe (SSE) region to embrace a contactless payment service where users can pay for a product in a matter of seconds.

Interest in the Visa payWave service has grown immensely in Georgia over the past six years since it was first introduced and today, Georgia was the leader of 17 countries in the CIS and SEE region, where Visa cards were issued, said a Visa spokesperson.

Nowadays more Georgian customers pay by Visa payWave than in 2009 when the company first entered Georgia. Visa payWave is a contactless payment solution based on EMV chip technology where users hold their card up to a special terminal and money is automatically deducted from their account.

With Visa payWave card consumers can pay almost instantaneously in one "wave” at any merchant equipped with Visa payWave contactless POS-terminal. A Visa payWave card doesn’t need to be swiped or dipped into the payment terminal, and customers do not have to sign or enter a PIN for transactions up to 45 GEL.

Visa payWay statistics of December 2014 shows supermarkets were the most popular places where people in Georgia used their Visa payWay cards.

Georgia was the first country in the CEMEA region (Central Europe, Middle East and Africa) where we piloted Visa payWave contactless technology in 2009. From 2013 we have seen a growing interest in Visa contactless payments in the region and in Georgia in particular, both on issuing and acquiring,” Visa Emerging Products and Innovations Director Andrei Shcherbina specifically told Agenda.ge.

Visa statistics showed in September 2014, Visa payWave experienced a whopping 2,746 percent year-on-year growth compared to the number of transactions conducted in September 2013.

In September last year there were 148,615 Visa payWave transactions in Georgia, which valued $1,845,748 USD. In this month the number of Visa payWave transactions made up 11 percent of all Visa transactions. The average value of a Visa payWave transaction was $12.42 USD – the maximum amount able to be spent using the payWave technology is 45 GEL.

Shcherbina elaborated on the results of the Visa payWave scheme in an interview with The FINANCIAL newspaper, where he said: "Georgians appear to be very progressive in terms of adopting payment technologies and banking technologies in general. It can be compared to only a very limited number of countries worldwide. Therefore, we expect for Georgia to soon become one of the leaders in cashless payment systems in the CIS&SEE region.”

The most popular areas where Georgians used their Visa payWave cards in September 2014 were in grocery stores and supermarkets, where 421,480 transactions were carried out and totalled $2,690,086. The next popular place was petrol stations, where 119,505 transactions worth $2,056,751 took place.

Other popular places where Visa payWave cards were used:

- Miscellaneous food stores (175,823 transactions totalling $1,960,959);

- Drug stores and pharmacies (107,213 transactions totalling $1,000,889);

- Restaurants (44,489 transactions totalling $521,684);

- Clothing stores (31,800 transactions totalling $864,169);

- Bars/taverns/lounges/clubs (28,390 transactions totalling $278,525);

- Cosmetic stores (14,355 transactions totalling $264,568);

- Automotive parts stores (4,190 transactions totalling $247,947); and

- Electronic stores (3,641transactions totalling $480,851).

The Visa statistics also revealed Polish visitors were more likely to use their Visa payWave cards to purchase items in Georgia than other international guests.

Polish travellers conducted 1,941 Visa payWave transactions worth $28,426 in September 2014, followed by the travellers from the Russian Federation (984 transactions totalling $38,226), Ukraine (830 transactions worth $14,405), Turkey (660 transactions worth $9,064), the United Kingdom (610 transactions valued at $6,776), Canada (458 transactions worth $6,524), Spain (358 transactions totaling $9,891), Germany (312 transactions worth $12,001), Slovakia (144 transactions valued at $52,975) and Cyprus (136 transactions worth $12,624.14).

In Georgia TBC Bank and Liberty Bank and the only two banks that issue Visa payWave cards, while banks that acquired the technology are TBC Bank, Liberty Bank, Bank of Georgia, Bank Republic and VTB Bank.

Among the first businesses in Georgia to adopt the Visa payWave service were MacDonald’s, Carrefour, GoodWill, and petrol chains like Gulf and Wissol.

- All currencies are in USD.

Tweet

Tweet  Share

Share