IMF announces regional economic outlook, including Georgia

International Monetary Fund (IMF) projected Georgia’s economic outlook as two percent in 2015 and three percent in 2016.

The Regional Economic Outlook Update for the Caucasus and Central Asia (CCA), released on May 19, predicted current growth trends in the CCA region would decline this year as a result of lower commodity prices and the economic slowdown in Russia.

The latest regional forecast by IMF said economic growth in the region will reach just over three percent this year.

"The twin shocks of the economic slowdown in Russia, a key trading partner, and lower oil prices are taking a toll on the region,” said Deputy Director of IMF’s Middle East and Central Asia Department Juha Kahkonen.

"Exchange rate developments such as the appreciation of the US dollar and the depreciation of the Ruble are compounding the problem. Overall, the outlook for the region has not been this weak since the global financial crisis in 2008-09,” Kahkonen added.

Growth will slow to 1.5 percent this year in the CCA’s oil importer countries; Armenia, Georgia, the Kyrgyz Republic, and Tajikistan, the IMF report said.

These countries are heavily dependent on remittances from Russia, which have fallen sharply. The drop in remittances has erased any gains from lower oil prices, and the current account deficit for these countries is expected to reach 11 percent this year.”

"These countries are also experiencing a reduction in export revenues as a result of lower commodity prices in general, as many of them export minerals such as gold, copper, and aluminum,” the report said.

Oil importers will see a rise in their fiscal deficits, from just over two percent in 2014 to about 4.5 percent in 2015. While some countries (Armenia and the Kyrgyz Republic) are temporarily increasing spending to boost domestic demand, all oil importers will need to return to fiscal consolidation soon in order to preserve their long-term fiscal health, the report emphasized.

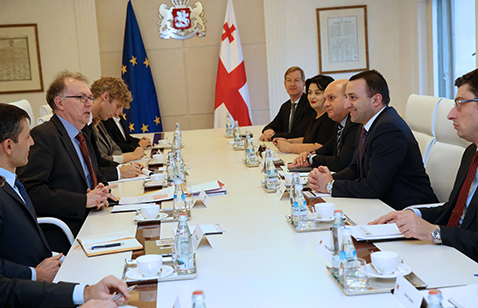

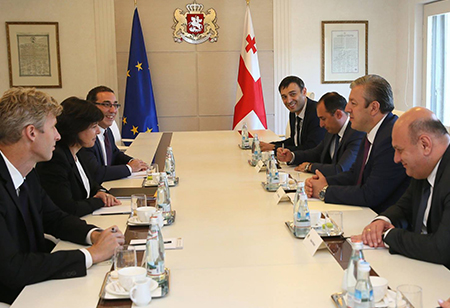

Meanwhile the IMF mission met Georgia’s Finance Minister Nodar Khaduri today at the National Bank of Georgia’s office in Tbilisi. The main topics of discussions were the currency crisis and the Government’s plans about how to overcome this challenge.

In one week’s time the mission will publish its conclusion about the Georgian Government’s activities.

Deputy Finance Minister Giorgi Kakauridze said the IMF mission will have consultations with Government representatives, after which the Government will decide how to correct the country’s 2015 budget.

Georgia’s Deputy Economy Minister Keti Bochorishvili said the Government will do its best to try to minimise the impacts external factors are having on the country’s economy.

Georgia’s national currency, the Lari, is beginning to stabilise since it began dropping in value against the US dollar about seven months ago. Meanwhile in the past two days the Lari has strengthened slightly.

In response, the National Bank of Georgia set a new exchange rate. From tomorrow, May 20, 1 USD will cost 2.3378 GEL. Previously the exchange rate saw 1 USD equal 2.3567 GEL.

According to the new exchange rate, the Lari also gained value against the Euro. From May 20, 1 EUR will cost 2.6204 GEL. The previous rate was 2.6895 GEL.

On another note the European Bank for Reconstruction and Development (EBRD) revealed its growth forecast for Georgia’s economy.

The document published by EBRD said Georgia’s economy was expected to decelerate from 4.8 percent in 2014 to 2.3 percent in 2015 and 2.6 percent in 2016, reflecting mainly a deteriorating external environment with recession in Russia and sharp slowdown of regional trading partners.

Tweet

Tweet  Share

Share