EBRD announces Georgia’s economy forecast

Georgia’s economy is expected to decelerate to 2.3 percent in 2015 and 2.6 percent in 2016, reflecting mainly a deteriorating external environment, with recession in Russia and sharp slowdown of regional trading partners.

Given the challenging external environment and some domestic political uncertainty, Georgia’s economy is expected to halve in 2015 from 4.8 per cent in 2014, said the European Bank for Reconstruction and Development (EBRD) document which provided the EBRD’s growth forecasts for its countries of operations.

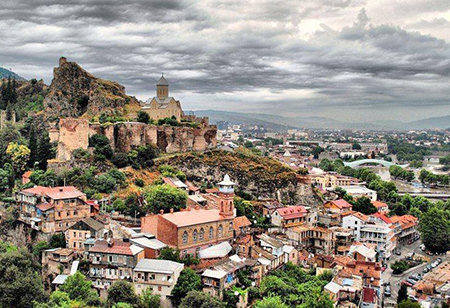

The document ‘Regional Economic Prospects in EBRD Countries of Operations: May 2015', which are released three times a year was published today within the EBRD annual meeting and business forum in Georgia’s capital Tbilisi.

The document said the outlook for the EBRD region has remained broadly unchanged since the last forecast in January. EBRD still expects overall stagnation, with however increasingly diverging sub-regional trends.

"Growth in 2015 is expected to reach almost 3 percent in Central Europe and the Baltics (CEB) and also improve in South-Eastern Europe (SEE). The outlook is also slightly brighter for countries in the southern and eastern Mediterranean region (SEMED),” the report noted.

The EBRD's Acting Chief Economist, Hans Peter Lankes, discusses Georgia's economic outlook on the publication of the Bank's latest set of regional prospects.

This more positive financial environment has added to the earlier lift from declining oil prices, explained the document. At the same time, deep recession in the Russian economy, which EBRD now projects to contract by 4.5 per cent in 2015, is having larger than expected negative spill-over effects on countries that have strong economic links with Russia, said the report.

Sharply lower remittance inflows from Russia, compounded by weaker export demand and investment inflows, put pressures on the currencies of economies in EEC and Central Asia. Belarus, Georgia and Moldova experienced the largest depreciations since the start of the year, of around 15 to 25 per cent against the US dollar (and around 5 to 15 per cent in trade-weighted terms). A number of countries in the region, including Armenia, Georgia and Moldova, hiked interest rates and / or intervened extensively in foreign exchange markets to limit currency depreciations, noted the document.

"The resulting lower exports and remittances have negatively affected growth and the external balance of payments. The Lari [Georgia’s national currency] has depreciated significantly by 18 percent since the start of the year, which, given the significant dollarization in the economy, is leading to increase in NPLs [nonperforming Loans]. Domestic political uncertainty is also weighing on confidence and growth.

"In 2016, growth is expected to remain still subdued at 2.6 per cent, affected by negative external environment, and increasing NPLs, as effects of the slide of lari in 2014-15 and downturn in economy will begin to crystalize,” the report noted.

EBRD document forecasted the overall outlook should improve in 2016 as average growth turns positive, though still at a meagre 1.4 per cent.

"Since January 2015, the outlook for the region as a whole has remained broadly unchanged and will improve somewhat in 2016, but this masks very different sub-regional trends. The key drivers are the European Central Bank (ECB)'s quantitative easing (QE) programme; monetary policy tightening in the US, which is now more widely expected to happen around early 2016; oil price stabilisation at around $60 USD per barrel of Brent; and the still elevated though broadly contained geopolitical risks related to the conflict in Ukraine,” said the report.

Tweet

Tweet  Share

Share